The number of venture-backed optical component startups has exploded. The Optical Component Startup Tracker identifies these companies and clarifies their value propositions.

Since many of these companies are in stealth mode, this tracker relies on the limited information available, either publicly or via conversations with the companies. Entries will be updated regularly as better information is available. The most recent update was January 17, 2025.

Feedback is always appreciated – you can reach us at https://cignal.ai/contact.

| Company Name | Value Proposition |

| Akhetonics | All-optical general purpose processor |

| Alcyon Photonics | Silicon photonics PICs |

| Aloe Semiconductor | Dual polarization of PAM4 optics to double fiber capacity without increasing baud rate |

| AttoTude | Low power connectivity inside the datacenter |

| Avicena | Arrays of micro LEDs for low power, massively parallel chip-to-chip optical interconnect |

| Ayar Labs | On-board optical interconnect engine chiplet and multi-wavelength light source for AI node bandwidth interconnect |

| Bright Silicon Technologies | Optical circuit switch company with unique MEMS technology |

| Casela Technologies | External pluggable lasers for CPO and high-power CW-DFBs for SiPho. |

| Celero Communications | Stealth startup, likely focused on coherent DSPs |

| Celestial AI | Optical chip-to-chip and chip-to-memory connectivity |

| Dream Photonics | System design kits for SiPho integration into standard foundries |

| Drut | Datacenter disaggregation via PCIe cards, MEMS switching, and coordination software |

| DustPhotonics | Silicon photonics for low-power, high speed optical interconnects |

| Effect Photonics | 100ZR DSP and highly integrated tunable laser assembly |

| Enablence | Optical chips for transcievers, LiDAR and other applications using PLC |

| Enlightra | Comb lasers for data communications |

| Enosemi | Silicon photonics based chiplets, custom silicon, and intellectual property products |

| Hyperlight | Thin film lithium niobate modulators |

| Innolume / Alfalume | Quantum well and quantum dot laser foundry and manufacturer. |

| Inpho | InP photonic integrated circuits |

| iPronics | Optical circuit switching using silicon photonics |

| Lessengers | Optical interconnect solution using direct optical wiring |

| Lightelligence | Computing engine with optical interposer, optical PCIe, and comb lasers |

| Lightium | Thin film lithium niobate foundry |

| Lightmatter | Photonic computing platform |

| Lightsolver | Optical compute platform to solver NP-hard problems in the optical domain |

| Lightspeed Photonics | Solderable compact optical interconnect for CPO and transceivers |

| Lightwave Logic | Polymer-based modulators for high speed datacom optics |

| LioniX | Small foundry with SiPho, SiN, and MEMS capability |

| Lucidean | Stealth startup apparently working on coherent modulation |

| Lumilens | Contract manufacturer of datacenter optics |

| Lumiphase | Barium titanate and silicon photonics |

| Mixx | Stealth startup developing silicon photonics for AI interconnectivity |

| Ncodin | Optical chip-to-chip interconnect with optical interposer and small-footprint laser |

| Neurophos | Optical inference computing hardware |

| Newphotonics | Optical signal equalization for LPO and other PIC products |

| Nexus Photonics | PICs with integrated active elements in InP, GaAs, GaN, and SiN |

| nEye Systems | Optical switching on a silicon chip |

| Nubis Communications | 3D optical interconnect for inside the AI node or CPO applications |

| Omniva | Data center efficiency improvements and liquid cooling |

| OpenLight | Silicon Photonics PDKs for integration into manufacturing |

| Oriole Networks | Stealth startup working on low-power AI optical interconnects |

| Phanofi | Stealth startup working on PIC designs for coherent solutions |

| PhotonicX AI | Stealth startup working on scalable optical interconnect technologies |

| Pilot Photonics | Comb laser-based PICs |

| POET Technologies | Optical layer interposers for easier integration of light sources, modulators, and other optical functions into chip packaging |

| Point2 | Mixed-Signal SoCs for low power and low latency AECs and Active RF Cables (ARCs) by using RF transmission over plastic dielectric waveguides (technically not optics, but optics adjacent). |

| Polariton | Small, fast PICs based on plasmonics |

| Quintessent | Quantum dot lasers and optical amplifiers integrated with SiPho-based PICs |

| Ranovus | Quantum dot lasers and silicon photonics for AI optical interconnects |

| Rapid Photonics | Thin film lithium niobate components |

| Retym | Stealth startup working on optical DSPs |

| Salience Labs | SiPho chip solutions for AI |

| Scintil Photonics | Integrating II-Vs with SiPho at wafer scale for hybrid PICs |

| Sicoya (Dawn) | Silicon photonics startup, now a part of Dawn Semiconductor |

| Skorpios Technologies | Integrating II-Vs with SiPho at wafer scale for hybrid PICs |

| TeraSignal | Analog electronics to provide active feedback (electrical) for LPO |

| Xscape Photonics | Programmable comb laser for WDM integration into AI fabrics |

Description and brief analysis of each company follows:

Akhetonics

Akhetonics (https://www.akhetonics.com/) is a German startup developing an all-optical general-purpose processor. Within the processor, all data is handled optically – including not only the optical interfaces, but also optical processing and optical memory. Akhetonics claims that moving to all-optical processing will not only save power, but also reduce design costs as fewer components will be required within the processors. Additionally, all-optical processing has the potential to scale bandwidth easier (via multiplexing) than traditional electrical processing.

The company had a €6 million seed funding round in November 2024 and plans to deliver its first product in mid-2025. The promise of all-optical computing has been around for decades. It remains to be seen if Akhetonics has finally found a way to bring it to market.

Source: Akhetonics

Alcyon Photonics

Alcyon (https://alcyonphotonics.com/) is a Spanish silicon photonics startup developing photonic integrated circuits (PICs) based on its portfolio of intellectual property and partnerships with silicon foundries. Products include photonic IP cores, which enable signal processing in the optical domain, as well as SiPho and InP design services for PICs.

Aloe Semiconductor

Aloe Semiconductor’s (https://aloesemi.com/) value proposition is based on doubling the bandwidth of PAM4 optics via dual polarization. The company was founded in part by a former Acacia silicon photonics engineer who has a pedigree of success and understanding of the optical interconnect business.

Polarization has been used in coherent optics since the start as a way to double bandwidth without doubling the baud rate on any one signal path. Keeping the baud rate low for a particular data transfer speed makes the electronics easier to design and increases the distance that the optical signal can travel. Aloe is trying to add polarization to the optical path in datacenter (PAM4) optics, where it has never been used before. As the data transfer speeds of PAM4 datacenter optics move from 200Gbps/lane (used in 1.6Tbps optics) to higher speeds, the distance that can be covered will be greatly reduced. 400Gbps/lane PAM4 optics will struggle to reach the 2km minimum required for many datacenter applications. By doubling the data transfer bandwidth to 400Gbps/lane while keeping the baud rate at 200Gbps/lane, dual polarization has the opportunity to extend the life of PAM4 optics into future generations.

As is the case with all new, non-standard technology, Aloe faces an uphill battle to have its technology incorporated into mass produced devices. There is currently nostandard for dual polarization at PAM4, and large scale datacenter optics deployments rely on multiple, standards-based sources. However, optical component vendors are desperately looking for ways to continue to sell PAM4 optics to datacenter operators, and Aloe offers a potential option – at least for one more generation. Aloe had a demonstration with Eoptolink at ECOC ‘24, signifying that at least one major manufacturer is willing to evaluate its technology.

AttoTude

Attotude (no website), the latest startup from Infinera founder Dave Welch and entrepreneur/university professor Joy Laskar, promises to reduce the cost and power of networking inside the datacenter. Details are not yet public. Dr. Welch was a champion of subcarrier multiplexing at Infinera and Dr. Laskar’s previous startups worked with milimeter wave wireless, which suggests that the company is working on something analog-adjacent electrical interconnect for internal datacenter connections.

Avicena

Avicena (https://avicena.tech/) is addressing the power bottleneck in optical interconnects that threatens to stifle future growth in AI node growth. Avicena proposes to move away from transceivers to very small LEDs using much less power for short-reach (up to 10m) interconnects. The company has presented its technology publicly, including at the most recent OCP conferences.

Power consumption within datacenters is an enormous and growing issue as AI nodes get ever larger. As datacenters become power limited, power that is dedicated to optical interconnect is power that cannot be dedicated to compute. Solutions like LPO and CPO are working to address power in traditional (2km to 10km) datacenter optics, while very short reach connections of a few meters are still using low-power copper connections. However, as speeds between chips increase, copper will run out of bandwidth. Avicena sees an opportunity for a new type of low-power optical connection – massively parallel, LED-based interconnect.

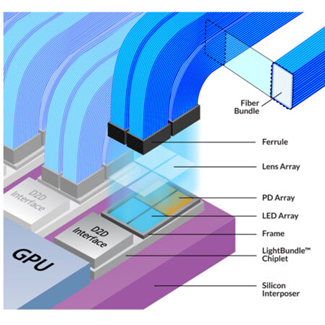

In the Avicena interconnect, arrays of GaN LEDs are coupled into fiber bundles that connect perpendicularly to the substrate. LEDs, by definition, are lower power optics but run at lower speeds and operate over shorter distances than lasers. With a grid of LEDs, Avicena can run each LED at much lower speeds and achieve a high aggregate interconnect speed. Doing so requires a chip to do the gearboxing (which adds power and space requirements), but Avicena claims that the overall link will be lower in power than alternatives.

Source: Avicena

Avicena faces the same challenge that any new technology faces when trying to enter the AI node: designs and builds are moving too fast to look at new approaches so long as existing approaches can be made to work. There is a chicken-and-egg issue at work. Large manufacturers don’t want to take a risk on an unproven and non-standard technology, but the technology can’t be proven at scale until someone takes the risk. Avicena has a set of executives with a strong track record in optics, so if anyone can find a way to get the technology accepted, it may be this group. But Avicena’s success depends on companies that historically have taken few strategic technical risks.

Ayar Labs

Ayar Labs (https://ayarlabs.com/) has been presenting its technology publicly for several years and is one of the first (if not the first) company to develop an optical chiplet applicable for CPO or other applications.

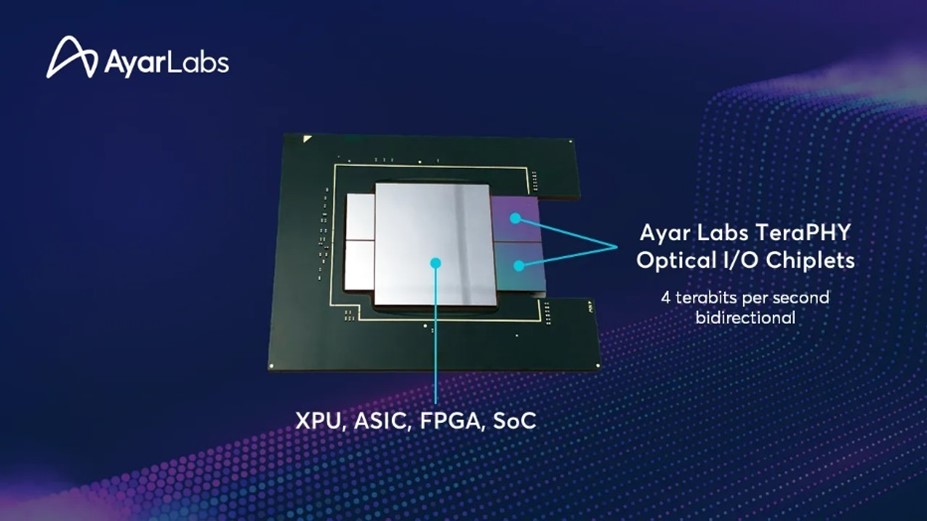

Ayar’s first product, the TeraPHY chip, incorporates 2Tbps of bandwidth via eight 256Gbps silicon photonics engines in a package designed to be integrated next to a switch, GPU, or other processor. The promise of co-located optical engines is lower power, lower latency, and better performance at higher speeds than traditional copper or optical pluggable solutions – which is why there are many companies working on solutions for this space. Solutions like CPO and LPO also address this application, but the solution from Ayar (and others) aims to integrate optics directly onto the processor substrate/MCM and is aimed more at inside the AI node connections that between node connections.

Source: Ayar Labs

To provide a light source for TeraPHY, Ayar has also developed a multi-wavelength light source called SuperNova. SuperNova can supply 16 wavelengths to power 16 ports (or two TeraPHY chips).

Ayar has been careful to comply with as many existing standards as possible (e.g. CW-WDM and UCIe specifications) to minimize the barriers to entry. And Ayar is further along that many other startups, with a defined product that has a public datasheet and some key investors (including Nvidia). However, Ayar will face the same issue as many others – until a large manufacturer decides to take a risk on the technology, it will be unproven at scale. With the speed that AI hardware is being developed and deployed today, no one wants to take the time to prove in a new technology until it is absolutely needed. Long term, the power and bandwidth requirements of AI builds will need innovative solutions like Ayar’s, but in the short term, adoption will be challenging.

Bright Silicon Technologies

Bright (https://www.bright-si-tech.com/) is a MEMS-based optical switch company using a different type of MEMS array that the company calls the “Lightfield Directing Array” (LDA). Industry insiders have indicated that Bright’s optical specs are impressive.

After Google’s announcements about the benefits of optical circuit switching (OCS) inside the datacenter, multiple technologies that enable OCSs were brought out of labs with new funding (LDA was originally designed for 3D television). However, all of the new OCS companies face the same issue: only one datacenter operator (Google) currently uses OCSs, and that operator is building its own hardware (see Cignal AI’s The Optical Circuit Switching Market).

Casela Technologies

Casela (https://www.caselatech.com/), was founded by ex-Santur / ex-Neophotonics laser experts including Dr. Milind Gokhale, former GM of the very successful Neophotonics laser devices business unit. Based in California, Taipei, and Nanjing, Casela is developing external pluggables lasers for CPO and high-power CW-DFBs for use in silicon-photonics-based DR and FR datacenter transceivers. The company has its own II-V semiconductor fab..

Celero Communications

Celero Communications (no website) is a stealth startup from CEO Nariman Yousefi, formerly in charge of coherent DSPs at Marvell / Inphi / Clariphy. No information is available yet, but one can surmise that low-power coherent DSPs could be a focus given the projected need in some applications for low-power coherent inside the datacenter at 3.2Gbps or higher.

Celestial AI

Celestial AI (https://www.celestial.ai/) has raised over $330 million and is valued at more than $1 billion – an AI optical unicorn. The company is developing a technology that it calls “Photonic Fabric” for optical chip-to-chip and chip-to-memory connectivity. Details are limited, but the technology appears to be like other optical chiplet technologies that aim to replace conventional copper interconnects with a co-located optical engine.

Celestial AI announced in March that hyperscaler customers are designing in Photonic Fabric optical chiplets as part of “an initial phase of technology adoption”, which is almost certainly the reason for its enormous valuation.

Dream Photonics

Dream Photonics (https://dreamphotonics.com/), founded out of the University of British Columbia, develops advanced design kits for manufacturing of silicon photonics devices within standard foundries. The company also has its own library of intellectual property for PIC development and has been working with customers since 2020.

Drut

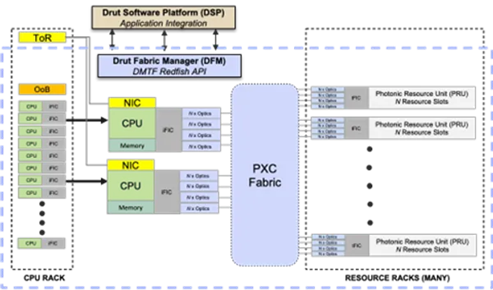

Drut (https://drut.io/) is developing a platform to enable AI node resource virtual disaggregation. This includes a comprehensive software stack as well as PCIe interface cards and a MEMS-based optical circuit switch. The combination allows resources such as memory and storage to be collected in pools and shared dynamically as needed.

Source: Drut

Datacenter resource disaggregation is an area of intense research and development, especially for smaller AI models that can be used (or leased) for multiple applications. Disaggregation is one of the potential applications that will spur OCS deployment inside the datacenter (see Cignal AI’s report The Optical Circuit Switching Market). Drut’s hardware (currently 32×32 port, scaling to 384×384 port OCSs), enabled by its advanced coordinating software, is aimed directly at that market, especially for smaller AI deployments that can benefit from resource pooling and dynamic allocation.

DustPhotonics

Dust (https://www.dustphotonics.com/) is an Israeli silicon photonics startup building high speed, low-power PICs for datacenter interconnect. The company cites its low-loss technique for coupling lasers to SiPho as an advantage. Initial products include 800G and 1.6T DR PICs for pluggable optics or CPO applications as well as 400G and 800G PICs with integrated lasers.

Effect Photonics

Effect Photonics (https://effectphotonics.com/), based in Eindhoven, purchased coherent DSP resources from Viasat in 2022 and aims to combine those resources with its ITLA technology to compete in the optical interconnect market. In particular, Effect has been talking about its plans for a 100ZR DSP competitor to Coherent’s Steelerton DSP, which started shipping in mid-2024.

Effect’s pico-ITLA (smaller than a nano-ITLA) is a low-power, tunable laser assembly that can be used in pluggable optics to reduce overall power consumption. The ITLA is designed specifically to meet the needs of coherent transmission and uses monolithic integration techniques to make it smaller than competing solutions.

Source: Effect Photonics

Effect’s 100ZR DSP was first anticipated in Cignal AI’s ECOC 2022 Show Report, but it has yet to see the light of day. The optical industry typically prefers to have at least two sources for critical parts like DSPs, so an Effect 100ZR DSP with performance equivalent to that of Steelerton will be a welcome addition to the market. The 100ZR market is not forecast to be large enough to support as many DSP vendors as 400ZR, but it should be healthy enough to support two.

Enablence

Enablence (https://www.enablence.com/) hails from Ottawa and isn’t technically a startup, as it is publicly traded and reported revenues of $1.2 million in 3Q24; mostly into Asia. The company designs and manufactures optical chips for transceivers, LiDAR, and other applications using planar lightwave circuits (PLCs). Enablence offers a wide range of products, including CWDM mux/demux, AWGs, and planar delay lines. The company also offers custom design and fab services.

Enlightra

Enlightra (https://enlightra.com/), founded in 2021 and based in Switzerland, designs comb lasers for data communication. As with other comb laser startups, it is not yet clear that there will be a demand for comb lasers in the datacom networks, but future OCS or WSS-based networks may require this level of integration.

Enosemi

Enosemi (https://www.enosemi.com/), founded by a team from Luminous Computing and Elenion (acquired by Nokia in 2020), provides silicon photonics based chiplets, custom silicon, and intellectual property products for integration into other processes. Current products include 16x112G (1.6Tb) TX and Rx chiplets. The company emerged from stealth in late 2023.

Hyperlight

Hyperlight (https://hyperlightcorp.com/) is an MIT spin-out focused on thin film lithim niobate (TFLN) modulators. Hyperlight has been a frequent public speaker at optical trade shows for the past few years and a major proponent of TFLN within the industry.

TFLN has a much higher bandwidth capability than either SiPho or InP. As the speeds of both datacenter and coherent optics increase, the speeds of individual channels are reaching the limits of those technologies. TFLN could provide a path forward beyond 200G/channel optics. For the next generation (1.6Tbps), current technologies are sufficient, so, while there have been demonstrations of 1.6Tbps modules using TFLN, the real market for TFLN starts at 3.2Gbps – somewhere after 2028.

There are multiple companies working on commercializing TFLN (Sumitomo Osaka Cement in Japan, Liobate in China, among others), but none have established commercial business yet, putting Hyperlight in a good competitive position.

Innolume / Alfalume

Innolume (https://www.innolume.com/) is a semiconductor laser fab specializing in InGaAs/GaAs quantum well and quantum dot lasers operating from 780nm to 1350nm (typically datacom wavelengths). Alfalume is its partner, offering DFB lasers based on the Innolume lasers. Quantum dot lasers, while more difficult to build, offer benefits like higher power, improved efficiency, and higher tolerance of reflections. Higher power lasers at datacenter wavelengths are well suited to DR optics, with which a single laser can be split among several modulators (SiPho or TFLN).

Inpho

Inpho (https://www.inpho.io/), founded in 2023 in Ontario, designs and builds PICs in InP using its proprietary manufacturing technology. Product categories include transmitters (EMLs and DMLs) and receivers (PIN-TIAs).

iPronics

iPhonics (https://ipronics.com/) is a silicon photonics startup out of Spain that is focused on lossless optical circuit switching (OCS) for datacenter.

iPronics uses a silicon photonics-based matrix with integrated SOAs to overcome the SiPho losses and provide a lossless switch. As opposed to MEMS, piezoelectric, or other technologies, the SOAs mean that the iPronics switch is not entirely transparent (SOAs have a wavelength requirement and bandwidth limit), but the tradeoff is a very compact, very low power, very fast switch matrix with zero loss.

iPronics faces the same challenges as all the other OCS vendors approaching the datacenter market (see The Optical Circuit Switching Market). For now, there is only one datacenter operator (Google) using OCSs, and that operator is building its own hardware.

Source: iPronics

Lessengers

Lessengers (https://www.lessengers.com/) is a Korean startup whose innovation is “direct optical wiring”, a way to connect active devices (lasers, photodiodes) to optical fibers without active alignment, lenses, or an air gap. The company sees applications for its technology in CPO/NPO as well as in optical transceivers. Initial products include a 200G optical engine as well as VCSEL-based optical transceivers (800G 2xSR4 and SR8, 400G SR4 and SR8, 200G SR4), and some AOCs.

The datacom optical transceiver market is crowded and dominated by companies with enormous manufacturing capability, so Lessengers will need a partner to scale its transceiver business. The company goal is more likely to be convincing a major manufacturer to adopt its direct optical wiring technology, which will face the same challenges as other companies developing innovative interconnect technologies – finding someone willing to take a risk on a new technology in the midst of a demand boom.

Source: Lessengers

Lightelligence

Lightelligence (https://www.lightelligence.ai/), founded in 2017 out of MIT, is developing processors with optical interposers for AI compute. The company introduced its Pace computing engine in 2021 and its Hummingbird “system in a package” in 2023. Hummingbird incorporates a 64-core AI inference accelerator ASIC with the cores connected flexibly by a programmable optical layer. Lightelligence also offers its Moonstone comb laser Photowave optical PCIe interconnect as standalone products.

Lightium

Lightium (https://lightium.com/) is an early stage thin-film lithium niobate foundry based in Switzerland. The company received $7 million in seed funding in 2024 to accelerate commercialization of its TFLN services.

Lightmatter

Lightmatter (https://lightmatter.co/) is designing what it calls a “photonic computing platform” which includes optical chiplets interconnected via an optical interposer and software that intelligently optimizes the optical and electrical processing. The goal is to build high bandwidth machine learning for AI at lower power and better performance per rack than conventional alternatives.

Lightmatter provides very nice corporate webpages with interactive graphics that are interesting to play with, but details beyond this are sparse.

Source: Lightmatter

Lightsolver

Lightsolver (https://lightsolver.com/), a spin-out from the Weizmann Institute in Israel, is developing an optical compute platform to solve NP-hard problems in the optical domain. The basic building block of its solution is a laser-based processing unit (LPU) that enables all-optical compute. Users generate a problem description using the company’s Python-based software package and run an optimization algorithm either on-premises or in the Lightsolver cloud.

Lightspeed Photonics

Lightspeed Photonics (https://lightspeedphotonics.com/), based in Singapore, builds products based on its solderable compact optical interconnect. The Lightkonnect optical engine can transmit up to 300Gbps (12 channels x 25Gbps/channel) currently and aims to grow to 400Gbps (4 channels x 100Gbps/channel by the end of 2025. Target applications include pluggable transceivers and CPO.

Source: Lightspeed Photonics

Lightwave Logic

Lightwave Logic (https://www.lightwavelogic.com/) is based in Colorado and is publicly traded,so not technically a startup. But with total sales of less than $25k in 3Q24, it has many of the same challenges as startups. The company develops polymer-based modulators for datacom. At OFC24, Lightwave Logic demonstrated 200G/lane modulators, which are required for 1.6TbE datacom rates (DR8, FR8). Electro-optic polymers have very high potential modulation speeds with low power consumption, giving them good potential for next-generation datacom modules, but the technology has strong competition in currently used technologies (SiPho, InP) as well as emerging technology TFLN.

LioniX

LioniX (https://www.lionix-international.com/) is a small foundry based in the Netherlands that offers custom builds based on SiPho and its own SiN waveguides and MEMS technology. SiN is used to build waveguides for low loss photonics integrated circuits. MEMS have gained in popularity recently due to growing interest in optical circuit switching, but MEMS also has use in sensors. The company is involved in a large number of R&D projects in Europe.

Lucidean

Lucidean (https://www.lucidean-inc.com/) is a UC Santa Barbara spin-out startup in stealth mode that is apparently working on coherent modulation. The founders’ research focused on silicon photonics, so the technology is likely aimed at coherent pluggables (less than Gen200). Among the company’s impressive co-founder/advisors is serial entrepreneur (and UCSB professor) Larry Coldren, who adds legitimacy to the company’s ambitions.

Lumilens

Lumilens (https://www.lumilens.com/) is a startup contract manufacturer of datacenter optics out of California with manufacturing in Thailand. Initial products include 800GbE DR8 and 2x400GbE FR4.

Lumiphase

Lumiphase (https://www.lumiphase.com/), a Swiss startup with IBM roots, has a value proposition based on its knowledge of Barium Titanium Oxide (BTO) as an electro-optical medium. Similar to TFLN, BTO has highly coupled electrical and optical properties, making thin-film BTO suitable for modulators and phase shifters. BTO is also tolerant to very high temperatures, making it compatible with standard CMOS and manufacturing techniques. Like TFLN, BTO hopes to capitalize on both the limited bandwidth and the high power consumption of current modulation technologies. Lumiphase is not just developing the BTO technology, but also building integrated optical chips that incorporate BTO modulators.

Lumiphase’s first product – a 130GBaud dual polarization IQ modulator with fully integrated passives, amplifiers, polarization multiplexer, and photodetectors – is planned for the second half of 2025. This product would be applicable to 800G coherent pluggables (Gen120C) or 800G LR, which probably puts the product too late for the initial development cycle, and it would have to rely on second generation design wins to lower cost or power. Other products floated by Lumiphase include optical switching and a roadmap to faster than 200GBaud (applicable to 1.6T coherent) modulation.

Source: Lumiphase

Mixx

Mixx (https://mixxtech.io/) is an early stage, stealth startup whose founders come from Broadcom’s silicon photonics group. The company is working on “breaking the connectivity barriers in the world of Artificial Intelligence,” which is essentially the same value statement as all of the optical chiplet startup companies. With the Broadcom backgrounds and focus on SiPho, one can infer that Mixx will be working on technology similar to Ayar Labs, Nubis, and others focused on reducing the cost and power of AI internal connectivity.

NCodin

Ncodin (https://ncodin.com/), out of France, is working on optical chip-to-chip interconnect for AI. The company has an optical interposer and its own small-footprint laser design.

Neurophos

Neurophos (https://www.neurophos.com/) is building inference computing hardware with its own optical modulators and optical processors. Its core technology is based on a proprietary “metasurface” technology that enables it to build very small modulators into very large arrays. The company is a spinout of Duke University and raised its seed round of funding in 2023.

Nexus Photonics

Nexus Photonics (https://www.nexusphotonics.com/), a John Bowers-founded company, is designing photonic integrated circuits with integrated lasers, amplifiers, photodetectors, modulators, and waveguides in a variety of materials including InP, GaAs, GaN, and SiN. The company targets a wide variety of applications from healthcare to AI and has already announced contracts with government and defense agencies.

Newphotonics

Newphotonics (https://newphotonics.com/) is an Israeli university spin-out with a variety of PIC-based target products aimed at improving optical connectivity inside the datacenter.

Among the initial target products for Newphotonics is its optical signal equalizer for LPO, which would allow signal optimization in the optical domain in the absence of a DSP. One of the biggest problems limiting the adoption of LPO is the inability to “clean up” the signal or get feedback on the signal integrity, and optical equalization could help to alleviate that issue.

Other products listed by Newphotonics include a monolithic 224Gbps SiPho/InP transmitter PIC and a CPO SiPho engine.

Source: Newphotonics

nEye Systems

nEye Systems (no website) is a stealth startup in Berkeley, California working on optical switching on a silicon chip aimed at the AI market. No further information is available at this time.

Nubis Communications

Nubis (https://www.nubis-inc.com/), founded by Bell Labs veteran Peter Winzer, has developed a low-power optical engine on a chip focused on low-power, high bandwidth optical interconnects. Unlike some other solutions, the interconnect is based on standard PAM4 channels and can interoperate with (e.g.) PAM4-based optical modules.

Nubis’ sweet spot is between rack interconnect (as opposed to other solutions focused on GPU-to-GPU connections), which is why the interface is standards-based and uses laser sources, not LEDs. The optical engine could be used for intra-rack or in-shelf applications or even in wireless fronthaul, but the company sees rack-to-rack as an easier entry point. The initial product is 16x112Gbps (1.6Tbps) per chiplet, which could be deployed in a CPO application or as a component in a pluggable optical module. The optical module route could give Nubis early access to revenue while the market for CPO matures, but 16x100G is not expected to be a popular option for 1.6TbE modules. Nubis may see more success with its expected next generation chiplet operating at 224Gbps, as the market for 224G/lane is just starting to develop.

Omniva

Omniva (https://omniva.com/), a stealth AI startup, has made news as much for its Kuwaiti funding as for its development plans. The company is working on immersion cooling and other technologies for AI, and at one point was working on building its own AI datacenters in the Middle East. Current efforts are focused on improving AI datacenter power efficiency.

OpenLight

OpenLight (https://openlightphotonics.com/) provides PDKs to manufacturers who want access to silicon photonics components in their semiconductor designs. Rather than develop SiPho IP independently, companies can come to OpenLight, purchase the correct PDK, and build it into their chiplets, transceivers, etc.

OpenLight’s heritage stems from startup company Aurrion, which was purchased by Juniper Networks in 2016 as part of a push to develop its own internal optical module business. In 2022, OpenLight was spun out from Juniper and began marketing its own open market silicon photonics platform.

As silicon photonics become an increasingly important part of low-cost datacenter optics and, eventually, CPO, OpenLight’s opportunity grows, especially among companies that do not have the resources to develop their own SiPho IP. OpenLight is also targeting applications outside of traditional datacom, including LiDAR and healthcare. These are smaller opportunities, but they afford diversification while awaiting potential datacenter revenues.

Oriole Networks

Oriole Networks (https://www.oriolenetworks.com/) is a stealth British spin-out from University College London that is focused on “reducing energy consumption of AI data centers”, which can cover a lot of ground. The company claims to be developing a technology that will use photonics to connect all of the GPUs in an AI cluster with very low power.

Phanofi

Phanofi (https://phanofi.com/) is a stealth startup in Denmark working on PIC designs for coherent optics. It does not appear to have its own DSP resources, but is instead working on the optical front end and collaborating with DSP vendors, aiming at high speed (e.g. 1.6/3.2T) solutions.

PhotonicX AI

PhotonicX AI (no website) is a stealth startup from Chongjin Xie, formerly of Bell Labs and Alibaba Cloud. The company is working on scalable optical interconnect technologies and products for AI computing.

Pilot Photonics

Pilot (https://www.pilotphotonics.com/), a startup based in Dublin, is developing PICs based on comb lasers. Target markets beyond communications include spectroscopy, sensing, and metrology.

Comb lasers produce multiple central frequencies that are regularly spaced on a wavelength grid. This structure allows a single laser source to generate the transmission wavelengths for multiple optical engines, thereby eliminating discrete laser sources and resulting in lower cost and power consumption. Comb lasers have not been widely deployed in telecommunications outside of some WDM-PON applications due to concerns about single point of failure, individual wavelength tunability and stability, and power. Pilot hopes to change that conversation with its fully integrated, gain-switched comb laser PICs. Initial products include single-wavelength tunable lasers, integrated comb lasers, and a comb source for laboratory use.

Source: Pilot Photonics

POET Technologies

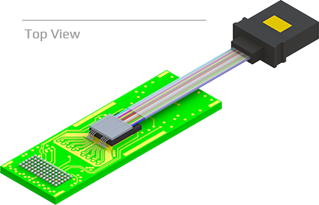

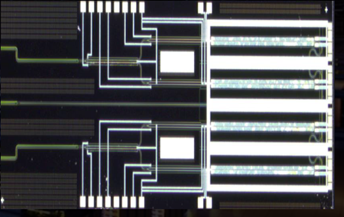

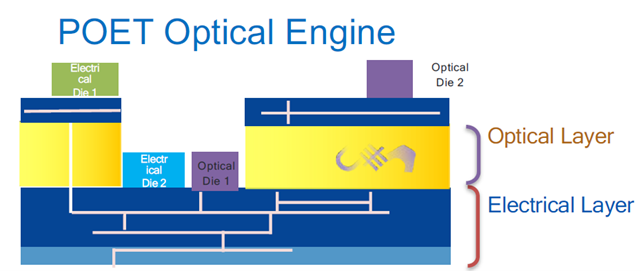

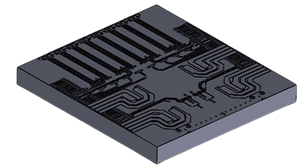

POET (https://poet-technologies.com/) has developed an optical interposer layer that integrates with standard manufacturing techniques to simplify wafer-layer integration of optical and electrical components. With the POET technology, electrical devices are still interconnected on the silicon wafer, but optical devices are interconnected via waveguides built into a layer on top of the silicon. The intent is to make very compact, fully integrated devices that combine all of the component parts at the wafer level rather than having to place and interconnect them all later.

Target applications include low-cost, highly integrated devices for datacom optical transceivers, where a single POET optical engine performs all of the primary transceiver functions. This should result in a lower cost device as the expense of positioning and assembling all of the component parts is eliminated.

POET has developed demonstration datacom pluggable modules based on its technology at 800G (2xFR4), transmitted chiplets for 400G-FR, and integrated light sources for CPO or similar applications. POET’s challenge will be to find a major manufacturer who is willing to take a chance with a new way of putting together optical modules. The current method may be inefficient, but it is proven and can churn out millions of modules every quarter. Sometimes the devil you know is preferable to the angel you don’t yet know.

Source: POET Technologies

Point2

Point2 (https://point2tech.com/) is developing low-power active electrical cable (AEC) SoC solutions for datacenters. The company’s core IP includes mixed-Signal SoCs for low power and low latency AECs and new Active RF Cables (ARCs) by using RF transmission over plastic dielectric waveguide to replace copper. As such, it isn’t technically an optical startup, but the company is attacking some of the same issues (interconnect power) that the optical interconnect companies are addressing.

Polariton

Polariton (https://www.polariton.ch/), founded in 2019 in Switzerland, provides very fast, very small PICs to academia and industry. The company’s core technology is the integration of plasmonics with SiP. Plasmonics, which have very high potential modulation speeds, show promise for next generation 400G/lane optics due to a high (>145GHz) bandwidth. This bandwidth rivals TFLN and exceeds current capabilities with SiPho and InP.

Quintessent

Quintessent (https://www.quintessent.com/), another John Bowers company, has a board composed of industry heavy hitters (Vitesse, Aurrion, Newport, Finisar, Lucent). Founded in 2019, the company is developing quantum-dot lasers and optical amplifiers and integrating them into SiPho-based PICs. The target application is chip-to-chip communication.

Ranovus

Ranovus (https://ranovus.com/about/) is an Ottawa-based startup offering multi-wavelength quantum dot laser technology and silicon photonics PICs.

Rapid Photonics

Rapid Photonics (https://rapidphotonics.com/) is a thin film lithium niobate (TFLN) company based in Amsterdam. The company’s differentiator is its patented method for building PICs from TFLN in a CMOS-compatible process. It offers a wide range of photonics components designed in TFLN.

Retym

Retym (https://www.retym.com/) is a stealth Israel-based technology company working on developing optical DSPs. Retym is following in the footsteps of previous Israeli DSP startup Banias Labs, which was purchased by Alphawave for $240 million in 2022.

Salience Labs

Salience Labs (https://saliencelabs.ai/), an early stage startup out of the UK, designs SiPho chip solutions for AI.

Scintil Photonics

Scintil (https://www.scintil-photonics.com/) has developed a multi-stage process to integrate epitaxial III-V devices with silicon photonics. The process involves building SiPho on a wafer with a buried oxide layer, flipping it onto another silicon wafer, removing the silicon substrate, bonding unprocessed InP dies onto the exposed oxide layer, then processing the InP dies into devices.

Unfortunately, silicon cannot be used to make a laser, so the biggest missing piece in SiPho development is integrating the InP lasers and other InP active devices. This marriage of silicon and complex semiconductors has been a source of manufacturing complexity and cost from the beginning of optical interconnects. InP cannot be grown directly on silicon due to a mismatch in the lattic structure that causes stresses and fractures in the InP. Therefore, methods like flip-chip bonding have been used. Scintil takes flip-chip bonding to another level with its two-flip process.

Scintil lists two types of products based on its technology: 2x400G and 2x800G FR4 chips for pluggable optics and a set of light sources for CPO. As with other startups working on optical chips, the largest barrier to operations Scintil faces is the current MOP, as large module vendors are reluctant to adopt a new technology while they work as fast as possible to meet the current demands of AI.

Source: Scintil Photonics

Sicoya (Dawn)

Sicoya (https://sicoya.com/) is a silicon photonics company founded in Germany in 2015. In 2020, Sicoya was integrated into Dawn Semiconductor of China. As such, the company is not really a startup anymore, but it is included in this list because it has the same technology and commercial challenges as many of the other silicon photonics startups listed.

Skorpios Technologies

Skorpios (https://www.skorpiosinc.com/), a US-based startup, has developed a way to directly integrate optical components made from other materials into silicon circuits – specifically silicon photonics circuits that can modulate light. The company achieves this by digging pits into the silicon at just the right places so that InP laser chips and other optical components can be dropped in without manual intervention. Skorpios is targeting both the datacenter and coherent optics markets with its process and already lists a variety of datacenter modules and coherent PICs in production.

Most competing technologies put the laser chips on the surface of the circuit and must couple the light down from the lasers into the silicon photonics. Skorpios’s technology puts lasers and other devices right in line with the silicon guides where the light needs to be. There are several advantages to Skorpios’s technology, including much better coupling of light and much better attachment to the silicon for heat dissipation. Skorpios’s technology is also much less labor intensive, as the entire process is automated, has relatively loose tolerances, can be tested on-chip, and the resulting chips are easily integrated into standard packaging processes.

Skorpios’s biggest competitor is the current method of operations (MOP), which is working well as scale. Typical assembly processes involve buying a laser assembly separate from the modulator (silicon photonics) and electronics and marrying the pieces together using fibers or waveguides. This process used to be very labor-intensive but it has become more automated and cheaper, especially in low-cost Asian labor markets. Skorpios’s technology aims to simplify the process by combining more functions at the component manufacturing stage before going to assembly.

The company does not have the manufacturing scale to be an independent datacom module supplier, so for large-scale success, a module or systems manufacturer will have to take a risk on an unproven (at scale) process.

Source: Skorpios Technologies

TeraSignal

TeraSignal (https://terasignal.com/) was founded by Dr. Armond Hairapetian, formerly of Broadcom’s Physical Layer Products business unit, which was responsible for 100Gbps PAM4 development. The company has developed an active electrical feedback link that could enable active tuning of LPO optics.

Power consumption in datacenter is reaching unmanageable levels, and LPO promises to cut power consumption of the optical modules by up to 50%. With LPO, the DSP in the pluggable optics is replaced by a lower power retimer and the SERDES DSP in the host switch silicon creates and decodes the signal. However, LPO has limitations that will limit its application within datacenters (see Cignal AI’s The Linear Drive Market Opportunity). Perhaps the biggest problem with LPO is that, by removing the DSP on the transmit side of the optical link, the link can lose integrity if conditions change, and the user has no feedback telemetry or method to tune the link in situ.

TeraSignal’s technology aims to remove this constraint by providing a real-time feedback loop. The TSLink re-driver includes an equalizer and digital sampler alongside an analyzer that can provide feedback to the switch or GPU SERDES to tune the link.

TeraSignal has an impressive pedigree and understands the problem that it is trying to solve. The opportunity for 800GbE – which has already largely been designed in – may already be past but there will be a smaller second wave 800GbE redesign opportunity and a larger opportunity at 1.6T. As with all other startups featuring innovative new technologies, the largest barrier to entry for TeraSignal is proof of scalability to millions of parts and the willingness of a major manufacturer to risk a development path on a newcomer.

Xscape Photonics

Xscape (https://www.xscapephotonics.com/) emerged from stealth in late 2024 and presented at OCP24. Its founders have experience in comb lasers and silicon photonics. The company’s initial products are programmable comb lasers (4-16 wavelengths currently, growing to up to 128 wavelengths eventually), and its argument is that DWDM will be needed in AI nodes because there will not be enough physical space for all of the optical connectors. By coming out of the AI chip (via CPO, for example) with multiple DWDM wavelengths, a single connector and a single fiber can carry multiple terabits of information – just like in metro and long-haul networks.

In the short term, there is no foreseeable demand for DWDM in AI nodes outside of FR optics. DWDM in general limits the radix possible from a processor as it collects a lot of connections onto a single fiber while non-DWDM architectures can allow wavelengths to be routed in any direction. What could be interesting is the intersection of DWDM and OCS (another technology that is being proposed for datacenters). Instead of an OCS, DWDM could allow wavelength selective switches (WSSs) to be used to route traffic. Like OCSs, WSSs only work if the traffic is well-defined and point-to-point, which requires significant additional design work on the part of the operator.